As a business owner in the industry, you may find yourself searching for a private equity firm.

However, Robert Brewster, the president and CEO of The Alaska Club, said before taking any steps to sell your business, you need to ensure you have a business to sell.

He added you can’t be the primary business asset. Prospective buyers will be looking closely at your people and if the business can operate without you. They’ll also be reviewing the quality of your product, your proprietary branding/unique operating proposition, whether your processes are documented and how profitable you are — most likely based on your EBITDA.

“Once you are confident you have prepared for the sale process correctly, the next course of action is to find the right investment banker or business broker to help you decide if your business is ready to sell, and who the best prospective buyers might be,” said Brewster. “Finding an entity that has a full range of contacts and knows how to engage with private equity, strategic and family office buyers is critical.”

The right partner is going to help you package your business for sale, identify the valuable attributes of your entity and engage you with the best pool of prospective buyers. Brewster noted trying to find buyers by yourself will almost always result in a lower sales price for your clubs.

“In order to find a broker that is going to work best for you, don’t take the first person you can get a hold of,” said Brewster. “Get references from industry sources and research firms that have been successful in marketing health clubs in the past. I would focus on investment bankers that specialize in helping sell healthy living companies. Their existing contacts will be invaluable.”

Additionally, you should conduct interviews, ask them about their experience, success rates, valuation levels they’ve achieved, engagement versus closing rates, and most importantly, if they think they can sell your business.

Something else Brewster noted that’s important is liking the people you are going to be working with. It’s a difficult process with a lot of work, so it’s vital to have people you get along with and trust.

There are a plethora of other things to consider before choosing a private equity investor. Brewster recommended asking yourself:

- Am I getting a price I am satisfied with?

- Does this sale meet my personal goals going forward — i.e. do you want to stay on full time or retire?

- Can I relinquish control and work with a board of directors?

- Are my people getting taken care of?

- Are the proper incentives in place for me to stay on?

- When I sell the business, should I do an asset or a stock sale?

Overall, choosing a private equity investor is a huge step as a business owner. If you believe you’re ready to start pursuing this route, ensure you have an experienced broker and a top-rate lawyer with experience in acquisitions.

“There are many aspects of a sales contract that only experienced professionals will know how to guide you through,” said Brewster. “The buyer’s attorneys will draft the contracts to benefit the buyer’s interest. Make sure you have the knowledge on your side to protect you from terms that might seem innocuous now but could be monumental later on.”

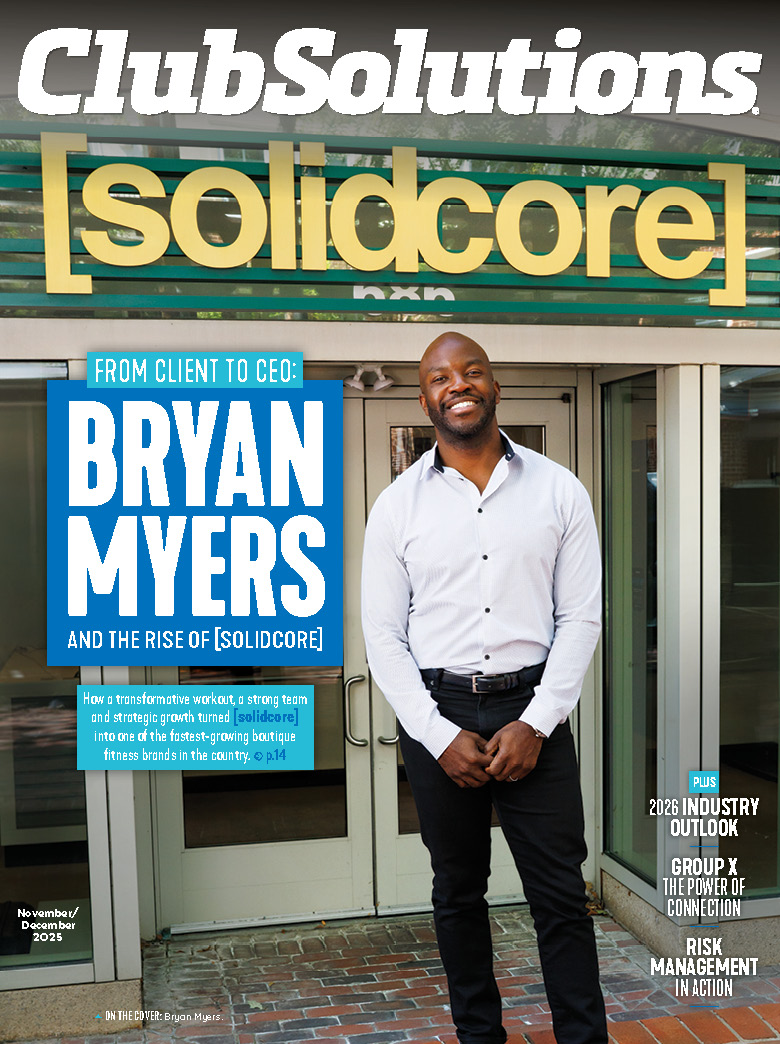

![From Client to CEO: Bryan Myers and the Rise of [solidcore]](https://d296qbqev3kq48.cloudfront.net/wp-content/uploads/2025/11/06151333/CS-NovDec25-CoverStory-3-350x250.jpg)