Three Ways to Avoid Gambling on Liability

Three Ways to Avoid Gambling on Liability

When addressing liability and risk management, there are common questions that pop up amongst club owners from east to west. Here, we took time to answer some of those questions, so that you can better protect your club from risk.

Question One: Should my personal trainers and instructors have professional liability insurance?

According to Frank Nusko, the senior vice president and chief financial officer of TCA Holdings, Inc., which owns Midtown Athletic Clubs, the answer to this question depends on a couple of different factors. “If they are employees, the next question is whether or not professional liability is excluded from your general liability coverage,” explained Nusko. “If so, then I would say yes, [trainers or instructors] should have professional liability coverage.”

However, Nusko believes that having an insurance policy that includes professional liability within the general policy is a wise investment. “Relying on a trainer who is an independent contractor to have this coverage puts the [responsibility] on the club to manage whether each of the trainers has the coverage in place,” he said. “Otherwise, the club could be responsible for a claim. In my opinion, the club should have professional liability coverage, since an injured party will sue all parties involved. And who has the deepest pocket — the trainer or the club?”

According to Eve Krieger, the financial director of Newtown Athletic Club in Newtown, Pa., another aspect to consider is whether or not your personal trainers or instructors are performing services off-site. “If your club offered these services off premises, you would need to make sure your policies do not have a ‘Designated Premises Endorsement’ [clause],” she said.

Because the answer to this question involves two components — your general liability policy and your employees’ personal liability insurance — it’s important to know who’s more at risk if an injury were to occur. This is where your insurance broker and provider can divulge insight into the best policy. “We as a club would not want to be dragged into a liability claim from the trainer providing services on their own behalf,” said Krieger.

Bottom line: Look for a general liability policy that includes professional liability coverage for both full-time and contracted employees. If it’s not included, it’s paramount that the instructors and trainers you hire are responsible for managing their own personal liability policy and keeping it updated.

Question Two: Even with a signed waiver, is my gym at risk for liability if an injury occurs?

Question Two: Even with a signed waiver, is my gym at risk for liability if an injury occurs?

Unfortunately, the answer to that question is yes. “Some states do not even allow a club to have waiver language in their membership contracts,” explained Nusko. “Also, you can run into a situation where a waiver signed 10 years ago did not cover an activity being done in the club today — for example, an offsite bicycling class, a scuba diving class, having children under 18 years old, etc.”

However, if your insurance policy does include waiver language in the membership agreement, it’s important for every person who enters your club to sign, even non-members. “At ROK Fitness, even if people come in for a tour, we have them sign a waiver,” said Craig D’Urso, the director of operations for ROK Fitness in East Rockaway, N.Y. “Anyone could trip over a weight or slip and fall.”

At Newtown Athletic Club, Krieger explained that waiver language is updated each year based on what its broker suggests, to place NAC in the best position possible. “Each state’s legal climate is a little different, but I would highly recommend that you maintain this document for every member and guest regardless,” said Krieger. “At the end of the day, it is another box that we can check off, stating that you have acknowledged that the activity you are participating in is dangerous, and that you are doing so at your own risk. As I indicated before, your insurance broker and carrier can help you with these forms.”

Bottom line: Have a waiver form, but don’t think that it’s fool proof. Keep a constant eye out for potential liability risks (wet floors or faulty weights), and take care of them immediately. In addition, consult with your insurance provider to update the waiver language as frequently as necessary, or when a new program is added.

Question Three: How should I develop a risk management strategy and what should it entail?

According to Nusko, one of the most important components to your risk management strategy involves prevention. “I would educate the management team on what I call having ‘risk eyes’ at all times when in the club,” he said. “For example, when walking the club, if you notice an extension cord running across the hallway, you see a lose tile on the stairs, the sidewalk is cracked at the entrance to the club — these are known risks for a potential accident. Have somebody responsible for risk at the club and have a risk committee that meets regularly to discuss areas of the club or activities being performed that might be a potential liability.”

Again, when developing an effective risk management strategy, remember to consult with your insurance provider. According to Krieger, if your insurance broker doesn’t specialize in health and fitness, you should find one that does. “You should also involve your insurance carrier — they are a great resource in terms of inspections, forms and identifying exposures,” she continued.

The next step involves educating employees on your risk management strategy. “Make sure you have a well trained staff that knows what to do if an accident occurs,” said D’Urso. At ROK Fitness, no matter how small an accident (say a member falls but says they’re fine), the incident is always documented. “We have gone through this with all of our trainers, instructors and staff,” said D’Urso.

“Also, keep this information handy for several years, since the statute of limitations in some states can be two or three years, meaning a claim can be made up to three years after an injury occurred,” continued Nusko. “If this occurs, the employees or member who witnessed the incident may not work for you any longer or be a member of the club, so it’s unlikely that you can go back to them, or if they are still with the club, that they will be able to recall what happened three years ago.”

Bottom line: When it comes to protecting your club from liability, it’s key that you have a risk management strategy in place. Consult with your insurance broker on how to develop one, and then educate every one of your staff (from janitors to management) on its details and processes to be followed.

By Rachel Zabonick

Stay ahead in the fitness industry with exclusive updates!

Rachel Zabonick-Chonko is the editor-in-chief of Club Solutions Magazine. She can be reached at rachel@peakemedia.com.

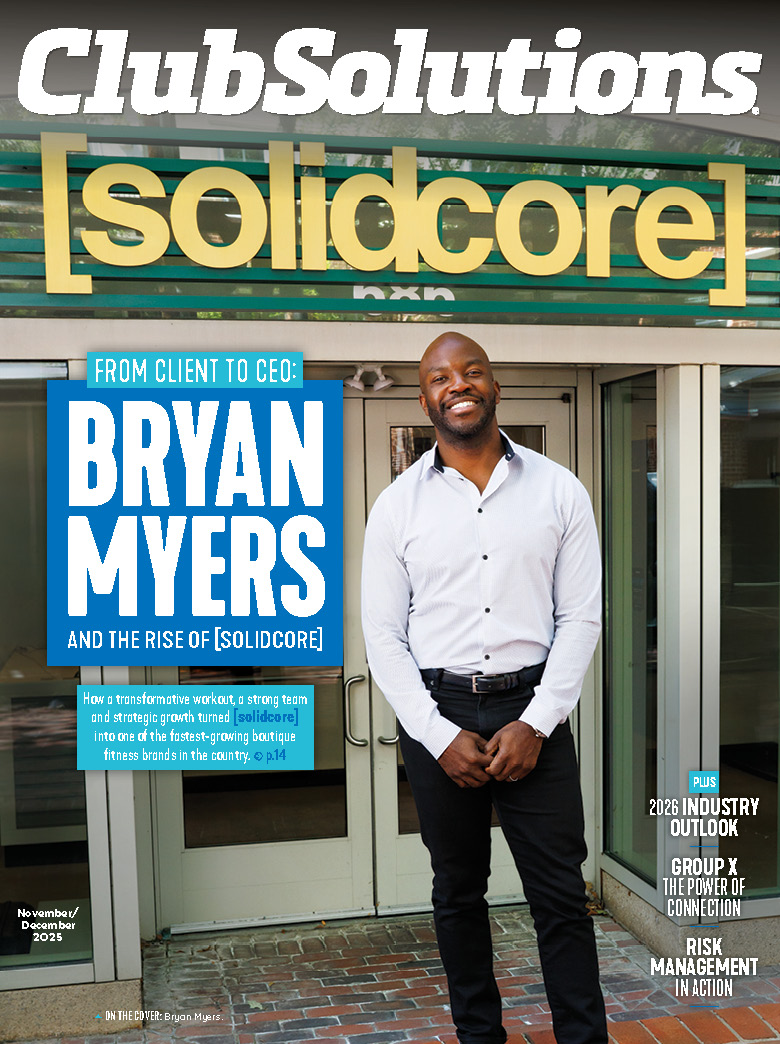

![From Client to CEO: Bryan Myers and the Rise of [solidcore]](https://d296qbqev3kq48.cloudfront.net/wp-content/uploads/2025/11/06151333/CS-NovDec25-CoverStory-3-350x250.jpg)