The heart and soul of any great company is it employees. Especially in a health club, your staff are the ones interacting with your members and working to improve the member experience day in and day out. Therefore, you want to build a strong company culture that not only attracts the best possible employees, but retains them long term as well.

Meredith DePersia, the vice president of human resource operations at Active Wellness, highlights a few ways the company works to boost its attractiveness as an employer, and offers a few suggestions on ways you can do the same.

What types of benefits do you offer employees? MD: A comprehensive benefits plan is an important component in attracting candidates applying for full-time employment. It can be a major differentiator between your company and another being considered. Many factors go into a candidate’s comparison between company sponsored health care plans. The greatest scrutiny involves levels of coverage, specific benefits covered, deductible and out-of-pocket maximum, participating doctors and employee premiums. It is important to be conscious of what candidates will look for in a plan they feel will meet their and their family’s needs.

At Active Wellness we advise employees to make their plan decisions based on choice, coverage and cost. Candidates will be reviewing whether there is a plan that allows them to continue their care with physicians, specialists and/or facilities they have become comfortable with. They will also be interested in whether the plans cover the services and treatments they value most. And finally, candidates will be reviewing the up-front payroll deduction costs, as well as potential long-term costs to them in the form of deductibles, co-payments and co-insurance.

It would be prudent to consider two coverage tiers for each benefit offered. Employees who utilize their health insurance plans will gravitate toward higher premium plans that offer lower deductibles and out-of-pocket maximums. Those employees who rarely utilize their plans will appreciate lower premium plans, the compromise being the higher deductibles and out-of-pocket costs if they do seek treatment.

Do you offer a retirement package? MD: Offering a 401(k) plan is a great way to encourage and support your employees in planning for their financial future. Whether or not your organization can offer a contribution match should not be the deciding factor in whether or not to offer a plan. The availability of a long-term savings plan is a key part of a well-rounded benefits package that should not be overlooked.

If you are offering a retirement plan for the first time, be prepared to spend time promoting the plan within the organization. 401(k) plans can be elected outside of the annual open enrollment period and should be promoted throughout the year. The more effort you put into educating employees on reasons to invest in a plan that pays off later, rather than now, will be key in boosting participation.

What other offerings do you have to boost your attractiveness as an employer? MD: Complimentary health club memberships for all employees is a huge draw for candidates. Taking it a step further and offering one complimentary adult add-on to full-time employees has great appeal. Offering an add-on membership at a discounted rate to part-time employees is a perk that is valuable to employees, whether they work 20 hours a week or two. And if possible, having a network of clubs that you can offer complimentary access to is a perk with an even greater value.

Why do you think it is important to offer these benefits to staff? How does it benefit you as a company? MD: Supporting the health and well-being of employees through a comprehensive benefit plan that includes health insurance, financial planning resources and therapeutic resources demonstrates a commitment to your organization’s vision and values. At Active Wellness our mission is to help build and inspire healthier, active lives, not only for our members, but for our employees as well.

What advice would you give to other club owners and operators who might want to start offering similar benefits? MD: For large organizations, finding and cultivating a relationship with an insurance broker who advocates for your organization is key in navigating the insurance world. And once you offer benefits, you need the resources for employees to call on for support. Having a human resource and/or benefits administrator is key to managing employee benefits. There are a lot of pieces to the insurance puzzle that need attention in regards to reporting, COBRA requirements and worker’s compensation claim management.

If an organization does not have this person in-house, outsource. Have an expert that can advise in the areas where the leadership does not have the skill-set to manage. Preparation and resources for employees must be a top priority when implementing a comprehensive benefits package.

Stay ahead in the fitness industry with exclusive updates!

Emily Harbourne is the former assistant editor of Club Solutions Magazine.

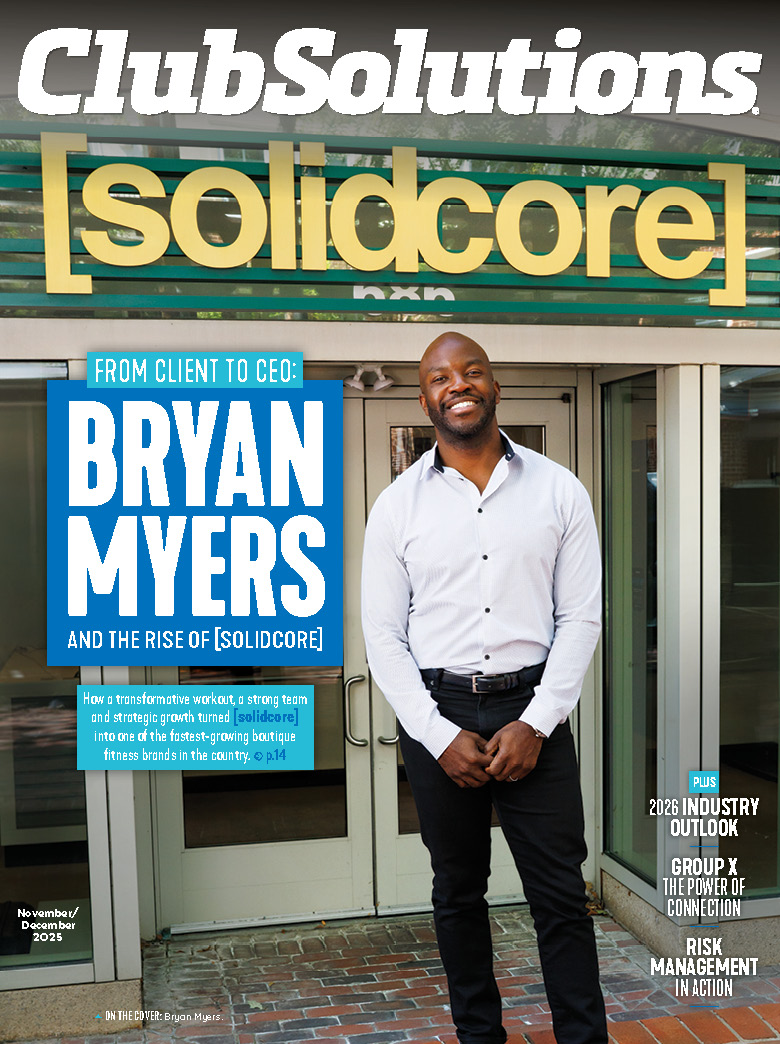

![From Client to CEO: Bryan Myers and the Rise of [solidcore]](https://d296qbqev3kq48.cloudfront.net/wp-content/uploads/2025/11/06151333/CS-NovDec25-CoverStory-3-350x250.jpg)