What’s trending in cardio equipment.

According to Global Market Insights (GMI), the U.S. cardiovascular equipment market is projected to grow at more than an 11% compound annual growth rate through 2027.

GMI’s report said this increase will be propelled by the sharp rise in obesity rates in the country resulting in diabetes, hypertension and cardiac arrests.

In March 2021, among the 71,491 U.S. adults who were hospitalized with COVID-19, about 50% were obese and 28% were overweight. The cardio fitness equipment market is poised to gain significant traction with the rise of health clubs and fitness centers incorporating advanced equipment catering to the changing consumer needs and demands.

One of these changing demands is the number of cardio pieces.

According to Anton Conlon, the CEO of Gold’s Gym, El Paso, most clubs have rows of cardio equipment, but the trend is moving toward minimizing sheer volumes of equipment in mid to higher value clubs.

“Instead, clubs are choosing better quality and lower volumes of cardio equipment but are helping members with interactive and personalized workouts through guided workouts such as Sprint 8 — a HIIT-focused cardio workout from Matrix you can use in clubs with cardio equipment,” said Conlon. “Pieces such as the S-Drive from Matrix also give an added challenge to regular gym members, which uses resistance for a tougher workout and varied body position. But it does require time and education for members to understand the benefits of such equipment as opposed to just hopping on a treadmill.”

When it came to selecting a cardio equipment partner, Conlon decided to use Matrix across their franchise.

“Their ClimbMills are always popular cardio pieces and are very reliable,” explained Conlon. “Members seem to like the various levels of difficulty, endurance and low impact. Group cycle classes are always packed, and I am always happy to run a slightly higher payroll in exchange for more cycle classes to keep our members happy — be it freestyle cycle classes or LesMills RPM classes.”

Another way Conlon is making his members happy is by keeping up with a major trend — technology-integrated equipment.

Integration is a popular trend, even between fitness tracker apps. Matrix’s integration with Myzone was another factor that made them a clear choice for Conlon. Gold’s Gym will be rolling it out in all of their clubs, including the third location in their franchise in El Paso, Texas, which is currently being built.

“We feel our members will really enjoy the benefits,” said Conlon. “Most modern-day cardio equipment has integration with many different fitness trackers. Myzone is just one of many technologies Matrix integrates with. Ultimately, the clubs provide the cardio equipment and members choose their own fitness tracker they already use or would like to use. This also helps with retention of members.”

When it comes to cardio, Dan Toigo, the senior vice president of iFIT Health & Fitness and managing director of Freemotion Fitness, agreed it’s all about the connected experience.

“The explosion of tech and data in fitness in general — with the pandemic further adding to the push toward digital and online fitness — means consumers have become very tech-savvy,” said Toigo. “As a result, there is now an expectation no matter how and where you exercise — whether in a club, at home or on the go — you should be able to record, track, and analyze your training and progress at every turn. Cardio is at the heart of that. Consumers want to see results displayed in a way which makes them easy to understand and benchmark.”

According to research conducted by IHRSA, most facilities lose 50% of new members within the first six months. Because of this, Toigo said it’s crucial to create an engaging environment for members both inside and outside the facility.

“Let’s face it, the pandemic has realigned exercise habits and how fitness experiences are consumed,” said Toigo. “As digital fitness journeys — which can be accessed wherever the exerciser is — increasingly become the default consumer expectation, facilities need to move beyond a brick-and-mortar club and develop a powerful physical and digital presence.”

Providing a whole ecosystem of fitness offerings to meet the new omnichannel needs and expectations of members is a challenge for many operators. Having engaging content is a key ingredient to combating this.

“While it’s crucial to ensure the hardware and equipment fits the needs of your consumers, you can’t afford to ignore the importance of the quality of content,” Toigo elaborated. “Not all content offerings are equal. While motivational content is essential, it simply is no longer enough. Consumers expect more. To really engage users and improve member retention, your cardio content must provide skills, concept and valuable insights.”

In his opinion, Conlon agreed consumers will no longer be accepting basic equipment. Instead, they will be demanding connected-equipment with more added value, and clubs should fulfill this.

“The days of selling 30 treadmills to a club and walking away without offering an interactive training program through an app, onscreen or through a fitness tracker are gone,” said Conlon. “Club spending on functional, resistance and HIIT-style cardio equipment will be a much bigger line item instead of buying a few token items to put in a corner.”

All in all, clubs are utilizing connected cardio to elevate the member experience.

“Always seek connected equipment that allows your members to extend their fitness journey beyond the walls of your gym while monitoring and tracking their progress,” said Toigo. “And don’t forget the content. Better content leads to a better experience, which in turn leads to better retention.”

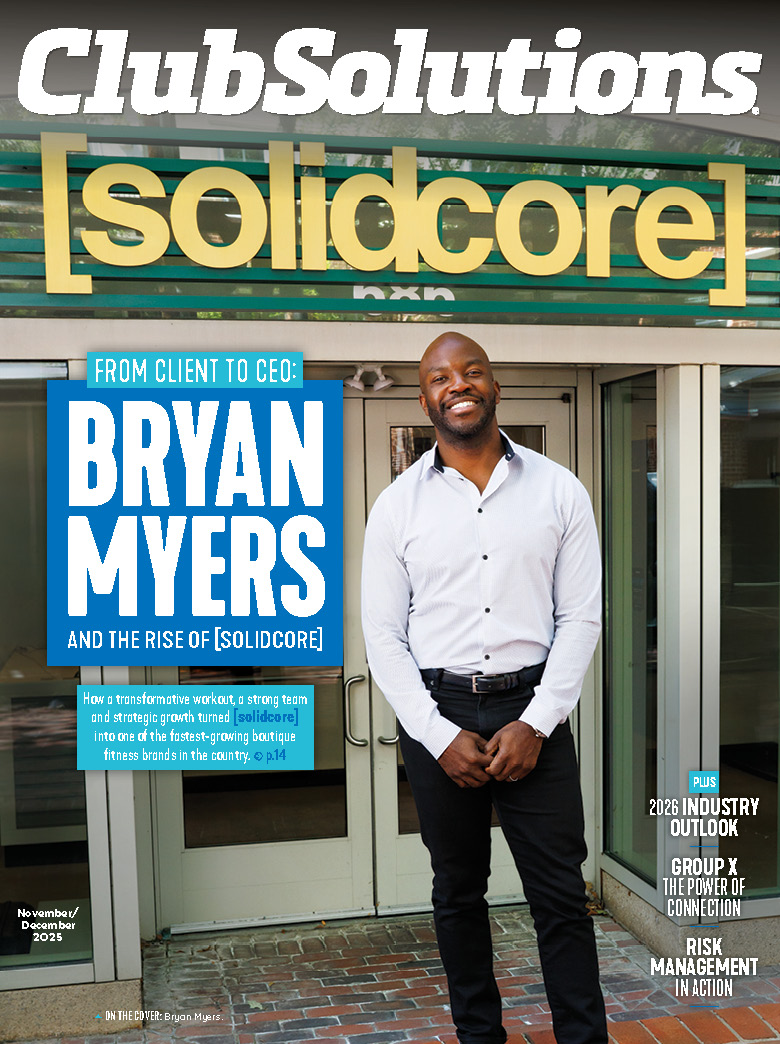

![From Client to CEO: Bryan Myers and the Rise of [solidcore]](https://d296qbqev3kq48.cloudfront.net/wp-content/uploads/2025/11/06151333/CS-NovDec25-CoverStory-3-350x250.jpg)